News

AAR : Works contract service to Inland Waterways Authority of India, not eligible for concession, taxable at taxable at 18%

West Bengal AAR holds that works contract service provided to Inland Waterways Authority of India (IWAI) for construction of a.....

AAR : Lease rentals paid during pre-operative period constitute ‘supply’ for immovable property construction, denies ITC

West Bengal AAR disallows Input Tax Credit (ITC) of lease rent paid during pre-operative period for leasehold land on which.....

AAR : ‘Evacuated Tube Collector’ not Solar Power based device or part thereof, denies concessional rate

Karnataka AAR holds that Evacuated Tube Collector (ETC)/Vaccum Tube Collector (VTC), part of solar water heater system, is not entitled.....

HC : Criticizes Revenue's drastic coercive approach, quashes bank a/c attachment & seizure absent proceedings initiation

HC quashes attachment of bank account u/s 83 of Gujarat Goods and Services Tax Act, 2017 (GGST Act) and seizure.....

AAR : Refutes giving any ruling due to insufficient information and generic nature of query

Madhya Pradesh AAR refuses to give any ruling in view of insufficient information provided in the Applicant, finding the nature of query.....

AAR : Denies concessional rate benefit for ‘works contract’ finding no nexus with power generation work

Madhya Pradesh AAR holds that Madhya Pradesh Power Generation Company Limited (MPPGCL) is covered under definition of ‘Government Entity’ but is not entitled to concessional rate benefit.....

AAR : Applies HC/AAAR ratio, upholds PP Woven Bags/sacks classification under chapter 39

Madhya Pradesh AAR holds that Polypropylene Leno Bags (PP Leno Bags) are classified under chapter 39 of GST Tariff and not under.....

AAR : ‘Mouth Freshener’ classifiable under Chapter Heading 2106, liable to 18% GST

Madhya Pradesh AAR holds that ‘Mouth Fresheners’ are classifiable under Chapter Head 2106 of the GST Tariff as ‘Food preparations not elsewhere.....

AAR : Projects under Government schemes carried out for business purpose constitutes “works contract”, taxable at 18%

Madhya Pradesh AAR holds that contract entered by applicant, a wholly owned subsidiary of MP Power Management Co. Ltd., carrying out function of distribution of electricity.....

AAR : 'Delayed payment surcharge' not a 'separate service', taxable basis 'initial supply' nature

Madhya Pradesh AAR holds that delayed payment surcharge/ Late payment surcharge/Surcharge on outstanding amount cannot be treated a separate service.....

NAA : Grants relief to Maruti Suzuki, finds no profiteering absent reduction in tax rate

National Anti-Profiteering Authority (NAA) dismisses case of profiteering against an auto-manufacturer finding no reduction in tax rate post introduction of.....

AAAR : Upholds GST on 'trade & commerce' activities of charitable trust; Distinguishes Sai-Publication ruling

Maharashtra AAAR upholds AAR order holding that the appellant, a public charitable and religious trust registered u/s 12AA of Income Tax.....

NAA : Finds no profiteering on supply where tax rate increased post-GST

NAA dismisses application alleging violation of provisions of Section 171 of CGST Act, 2017 on supply of ‘Handloom Design –King.....

NAA : Dismisses application, finds no profiteering either post GST implementation or rate reduction

NAA dismisses application, finds no contravention of provisions of Section 171 of CGST Act, 2017 either post GST implementation w.e.f......

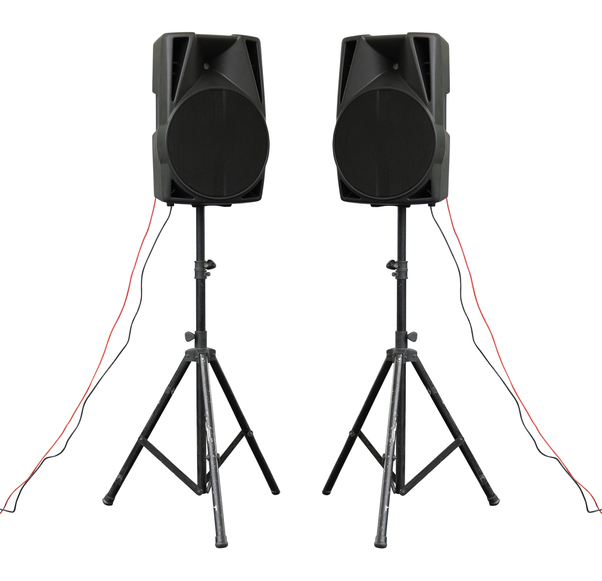

NAA : Dismisses application, absent base-price increase finds no profiteering by ‘Speaker’ supplier

NAA finds no case of profiteering u/s 171 of CGST Act, 2017 on supply of “PA Ceiling Speaker” and “PA.....

NAA : Increase in base-price due to discount reduction does not amount to profiteering

NAA dismisses application alleging violation of provisions of Section 171 of CGST Act, 2017 in respect of supplier of ‘Paint’.....

NAA : Upholds profiteering by L'oreal distributor, directs investigation for subsequent period

National Anti-Profiteering Authority (NAA) upholds a case of profiteering u/s section 171 of CGST Act 2017 against a distributor of.....

AAAR : Upholds AAR, Employees service in corporate office to distinct units constitutes’ supply’

Karnataka Appellate Authority for Advance Rulings (AAAR) upholds decision of AAR that activities performed by employees at its Indian Management.....

.jpeg)

HC : Issues notice in writ challenging levy of GST on transfer of development rights

Bombay HC issues notice in writ challenging Notification No. 4/2018 - Central Tax (Rate)/State Tax (Rate) dated January 25, 2018 dealing with levy of GST on transfer.....

HC directs High-Level Committee constitution to consider granting relief upon Entertainment tax abolition

Bombay HC requests Govt. to constitute High Level Committee comprising of Principal Secretary of Finance and Secretary of Tourism Dept. for granting.....