News

.jpeg)

HC: Provision enabling assessment/collection mechanism not per se arbitrary, dismisses writ

Rajasthan HC dismisses the writ challenging vires of Section 6(1) of the GST Act, 2017 reasoning that ‘formation of a.....

AAR: Supply of systems/sub-system/on-board spares for use in Navy's warships, taxable at 5%

Karnataka AAR rules that various systems, sub-systems and onboard spares supplied by the applicant for use in the warships, vessels.....

AAR: Supplies/Material received from contractee includible in taxable value of works-contract

Maharashtra AAR clarifies that tax is payable on the entire contract value without deduction of value of the material provided.....

AAR: “Logging” of trees does not yield any ‘agricultural produce’, taxable as intra-state supply

Karnataka AAR holds that operations of “logging” would be liable to GST clarifying that said activity does not yield ‘agricultural.....

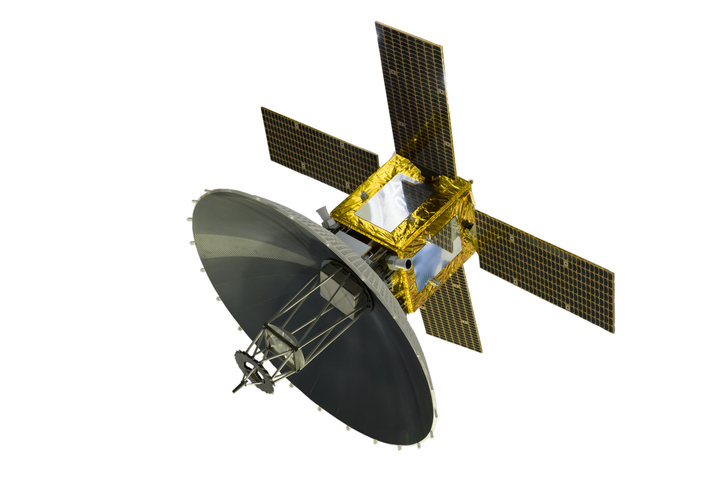

AAR: Leasing of Satellite Transponder taxable as part of space segment at 5% IGST

Karnataka AAR holds that service of Leasing of Satellite Transponders, covered under SAC 9973 19, falls under the Entry No......

Madras HC admits exporter's writ challenging denial of ITC refund on 'capital goods'

Madras HC admits writ challenging validity of Rule 89(4)(b) to the extent it denies refund of ITC on capital goods.....

RWA’s eligibility to exemption on amount collected “upto Rs. 7500" under Madras HC scanner

Madras HC issues notice to Revenue in writ challenging order of Tamil Nadu Authority for Advance Ruling (AAR) which denied.....

HC: Citing no revenue-loss to Govt., quashes provisional bank-account attachment for circular trading

Gujarat HC quashes orders of provisional attachment of bank accounts of writ applicant u/s 83 of CGST Act alleging circular.....

HC: Grants regular bail to applicant arrested for fraudulent ITC availment/tax-evasion

Gujarat HC releases applicant (accused) on regular bail in connection with alleged offence for contravention of section 132 (1)(b) and.....

AAR: Supply of security, cleaning, housekeeping and sweeping services to Govt. hospital not exempt

West Bengal AAR denies exemption from payment of GST to the applicant engaged in supply of facility management services such.....

AAR: Service relating to establishment/management of hospitals/similar health facilities by 100% State-owned entity, exempt

West Bengal AAR holds the applicant eligible for exemption on supply of any service in relation to establishment and maintenance.....

HC: Allows release of seized vehicle/goods upon furnishing bank guarantee

Gujarat HC directs the Revenue to release seized vehicle along with the goods contained therein subject to furnishing of bank.....

HC: Grants interim release of goods on payment of tax & penalty, subject to final outcome of writ

Gujarat HC directs the Respondent to release the conveyance and the goods finding that the applicant had paid an amount towards.....

.jpg)

HC: Directs release of vehicle and goods while allowing continuation of proceedings initiated

Gujarat HC orders release of vehicle as well as goods confiscated u/s 129 of CGST Act on deposit of requisite.....

HC: Quashes detention order passed where E-Way Bill was regenerated upon expiry

Patna HC quashes the detention order in case where assessee regenerated the E-way bills upon expiry of its validity period;.....

HC: Directs correction of mechanism of common portal for filing annual return, acceptance of rectified GSTR-3B

P&H HC directs Revenue to make correction of mechanism of operation of Common Portal in consonance with Notification No. 74/2018-Central.....

HC: Quashes provisional attachment of bank-account/trading assets by State-Tax Officer u/s 83

HC quashes order of provisional attachment of stock of goods as well as current account passed by State Tax Officer.....

AAR: ‘Deposit work’ facilitated by a Transmission licensee constitutes ‘supply’, taxable at 18% GST

Rajasthan AAR holds that transaction of facilitating execution of Deposit Work requiring modification/augmentation/shifting/additions to applicant’s transmission system at the specific.....

AAR: Construction/erection/commissioning/completion of ‘Bridges’ as a sub-contractor, taxable at 12% GST

Punjab AAR rules that services of construction/erection/commissioning/completion of ‘Bridges’ provided by applicant as a sub-contractor fall under Serial No. 3(iv).....

SCN issued by State GST Officer challenged on ground of doctrine of 'Rule Against Bias'

Madras HC issues notice in writ petition challenging show cause notice (SCN) issued by State GST Officer as also Circulars.....