News

AAR: Bentonite Powder, commercially known as “Back Fill Compound”, taxable at 18%

Kerala AAR classifies “Bentonite Powder” used for electrical earthing under the Heading 38249917 taxable at 18% as per Sl. No......

AAR: ‘Cervical Pillows’ facilitating comfort sleep, not ‘orthopaedic appliance’, taxable at 18%

Kerala AAR classifies ‘Cervical Pillows’ under HSN 94041000 taxable at 18% GST as per Sl. No. 438 of Schedule III.....

AAR: ‘Disposable underpads’ functionally similar to sanitary towels, taxable at 12%

Kerala AAR classifies ‘disposable underpads’, for use by bed ridden patients to protect skin from moisture, under HSN 96190090 taxable.....

AAR: Repairing services rendered to customer alongwith supply of spare parts/accessories not composite supply

Kerala AAR holds that applicant's activity of rendering repairing services for boats/vessels along-with supply of spares and accessories cannot be.....

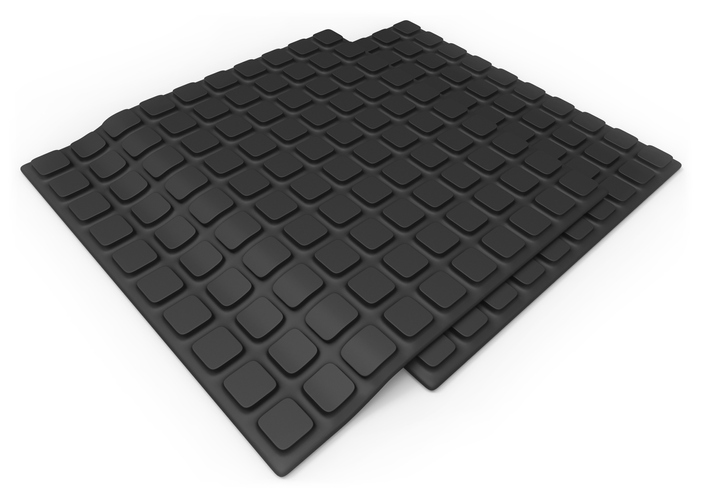

AAR: PVC Tufted mats classifiable under HSN 5703 90 90 taxable at 12% GST

Kerala AAR holds that PVC Tufted Coir Mats and Mattings are classifiable under Customs Tariff Head 5703 90 90 liable.....

AAR: Rules on taxability of confectionary products, sweets, namkeens

Kerala AAR holds that applicant's products ‘Peanut candy’ and ‘Gingelly candy’ being confectionery products made by heating a variety of.....

AAR: Ready to eat items sold over counter does not qualify as ‘restaurant service’

Kerala AAR holds that resale of food & bakery products does not fall under restaurant service while clarifying that a.....

AAR: Rules on liability to pay GST by the principal and job worker during job work

Kerala AAR holds that 18% GST rate is applicable for job work charges to be paid by the applicant (a.....

AAR: Medicines, surgical goods supplied to in-patients exempt as composite supply of health care services

Kerala AAR rules that applicant's (a multi-speciality hospital engaged in providing health care services) supply of medicines, drugs and other surgical goods.....

AAR: Design, commissioning of Wind Tunnel for Central Govt. constitutes ‘works contract’, liable to 12% GST

Kerala AAR hold that applicant’s work of design, realisation, integration and commissioning of 1.2 m Trisonic Wind Tunnel to Vikram.....

AAR: Rejects Chennai Port Trust's arguments vis-a-vis Time of Supply on delayed/uncertain rental receipts

AAR rejects Chennai Port Trust's contention vis-a-vis time of supply in relation to the renting of its immovable properties to several Govt. agencies.....

AAR: Classifies Carbonated Fruit Juice under CTH 22021020 or 22021090 depending upon flavour added

Tamil Nadu AAR rules that the products ‘Richyaa Damer Lemon’ and ‘Licta Lemon’ supplied by the applicant is classifiable under.....

AAR: Allows ITC on real estate brokerage services used for renting out property

Tamil Nadu AAR holds the applicant eligible to take credit of the GST charged for real estate brokerage services rendered.....

AAR: Medicines, consumables, etc. supplied to in-patients, being naturally bundled, classifiable as composite ‘health-care’ service

Tamil Nadu AAR holds that supply of medicines, consumables and implants used in the course of providing health care services.....

AAR: Tamarind before undergoing drying process classifiable as ‘Fresh Tamarind’ under HSN 08109020

Tamil Nadu AAR holds that tamarind supplied by applicant which has not undergone the process of direct drying in sun.....

Gujarat HC's notice over ITC disallowance of taxes paid pursuant to adjudication proceedings

Gujarat HC issues notice in writ challenging the constitutional validity of Section 142(8)(a) of CGST Act, 2017 to the extent.....

AAR: Classifies Air Handling Units under HSN 8415 9000 and Air Ventilators under HSN 8414 5910

Karnataka AAR classifies Air Handling Units under HSN 8415 9000 and Air Ventilators under HSN 8414 5910; Notes that Air.....

AAR: Leasing of e-learning facilities taxable at the rate of 18% GST

Karnataka AAR holds that supplying of e-campus solutions involving various e-learning facilities along with hardware to various organizations on a.....

AAR: Sub-leasing of non-residential property taxable at 18%, additional facilities transferrable to tenant taxable at respective rates

Karnataka AAR holds that renting of premises allotted by Karnataka Industrial Development Board (KIDB), being a non-residential property and constructed.....

AAR: Selling rice under unregistered Brand name foregoing actionable claim, exempt from GST

Karnataka AAR holds that manufacturer of rice who sells rice under Registered Brand name are liable to pay GST @5%;.....