News

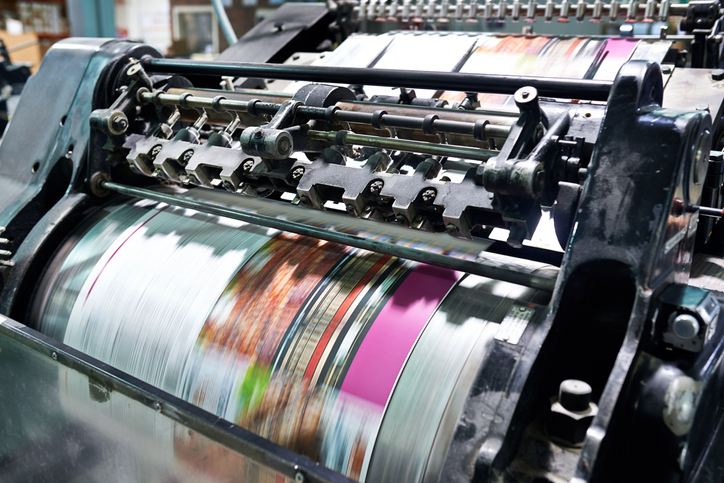

AAR: Printing on required PVC material constitutes a supply of service, classifiable under SAC 9989

Karnataka AAR holds that the activity of printing the advertisement material, where the content is supplied by the recipient on.....

AAR: Skill Development training services to construction workers rendered under sub-contract, not exempt

Karnataka AAR holds that 18% GST shall apply on services provided under sub-contract to main contractor, who in turn provides.....

AAR: Electroplating work constitutes a ‘supply of service’, classifiable under SAC 9988 as ‘Manufacturing Services’

Tamil Nadu AAR holds the electroplating activity undertaken by the applicant as a ‘Supply of Service’ classifying it under SAC.....

AAR: Transfer of ownership in moulds to Indian Buyer without physical import liable to GST

Tamil Nadu AAR holds that GST is liable to be paid on transfer of title in moulds from applicant to.....

NAA: Upholds profiteering against a real-estate developer for not passing additional ITC benefit post GST

NAA upholds a case of profiteering against a real-estate developer engaged in supply of construction service under the Pradhan Mantri.....

NAA: Holds Samsung India guilty of profiteering on ‘television & power bank’ supply

NAA upholds a case of profiteering against Samsung India to the tune of Rs. 38 Lakhs (approx.) under Rule 133.....

NAA: Directs re-computation of profiteering against Subway System's franchisee considering actual-price post rate-reduction

NAA directs Revenue to re-investigate the matter and re-compute the amount of profiteering alleged against a franchisee of M/s Subway Systems.....

.jpeg)

HC: Rejects CA's bail petition again, directs him to compounding process

Calcutta HC rejects Chartered Accountant's Petition for bail, however reiterates that the Trial Court may release Petitioner on bail if.....

AAAR: Declares AAR order void since matter already pending DGGI investigation

Karnataka AAAR holds the AAR order to be void-ab-initio for being vitiated by the process of suppression of material facts; Observes.....

AAAR: Reverses AAR, disallows exemption on commission earned on cut-flower auctioning

Karnataka AAAR sets-aside order of AAR, holds that commission earned from auctioning of high-quality cut-flowers is not eligible for exemption as.....

AAAR : Reverses own order, conversion of steam-coal received from Principal into electricity constitutes ‘job work’

AAAR reverses its earlier order, holds that coal qualifies as an input under an arrangement where the same is supplied by.....

SC: Dismisses SLP challenging P&H HC-order permitting TRAN-1 filing/revising beyond stipulated date

SC dismisses SLP against order of P&H HC which held that carry forward of unutilized pre-GST credit, being a ‘vested.....

HC: Copy of order staying NAA order in Johnson & Johnson case

Copy of Delhi HC order granting stay on the operations of NAA order in Johnson & Johnson case is now.....

HC: Calls upon Revenue to examine if pending GST proceedings are covered under ‘moratorium’

Gauhati HC sets-aside order passed by Commissioner noting that Commissioner failed to examine whether ‘proceedings pending before GST authority’ is.....

HC: Milk chilling and packing support services exempt from GST, quashes Circular levying 5% GST

Gujarat HC quashes Circular No. 354/292/2018-TRU which clarified that GST @ 5% is leviable on the activity of chilling and.....

HC: Summons/inquiry against Directors alleging fraudulent ITC claim challenged before Uttarakhand HC

Uttarakhand HC hears writ challenging summons & inquiry initiated against Directors of a Company (Petitioners) on allegation of fraudulent input.....

HC: Quashes demand notice issued in violation of principles of natural justice

Patna HC quashes the demand notice issued against the petitioner on the grounds of violation of the principles of natural.....

HC: Directs authorities to take decision regarding inadmissible ITC

Patna HC directs the authorities to examine the order holding ITC to the tune of Rs. 55 lacs (approx.) as.....

.jpeg)

HC: Releases goods provisionally directing adjudication in accordance with law

Gujarat HC disposes writ noting that proceedings “are at the stage of show-cause notice” and "shall go ahead in accordance.....

HC: Permits uploading of TRAN-01 for availing transitional credit, considers difficulties faced in accessing new system

Madras HC observes that the petitioner should be permitted to upload Tran-1 declaration and avail transition of credit; Holds that.....