News

AAAR: Depositing timber with Govt. depot for disposal chargeable to GST

Karnataka AAAR upholds AAR holding that depositing timber with Government Timber Depot (GTD) for disposal would amount to ‘supply’, liable.....

AAAR: Rules on classification of ‘Carbonated fruit juice’, Council meeting discussions have persuasive value

Tamil Nadu AAAR upholds AAR ruling that ‘Carbonated Beverage with Fruit Juice’ supplied by appellant are neither classifiable under as.....

AAAR: Sub-contractor's supply of gardening and landscaping work for Govt. not exempt, upholds AAR

Karnataka AAAR confirms the AAR order that the supply of services by sub-contractors to the Appellant being the recipient of.....

AAAR: Upholds GST on renting of temporary residential rooms/dormitory to devotees by a 'religious charitable trust'

Karnataka AAAR upholds AAR ruling holds the appellant liable to pay tax on renting of temporary residential rooms of all.....

AAAR: Land development under JDA constitutes ‘supply of service’, not ‘sale of land/plot’; Upholds AAR

Karnataka AAAR upholds the AAR order that the activity of development and sale of land carried on by the Appellant.....

.jpg)

AAAR: Allows ITC on detachable sliding/glass-partitions fitted in co-working space, sets-aside AAR

Karnataka AAAR allows ITC on procurement of detachable sliding and stackable glass partitions fitted in building for co-working work-space/office-space being.....

NAA: Directs Builder to pass balance profiteered amount as determined to flat buyers with interest

NAA holds Builder guilty of profiteering to the tune of Rs. 2.7 crores (approx.) for not passing additional ITC benefit.....

NAA: Upholds profiteering on “Fly Ash Blocks” supply, rejects 'inverted duty structure' plea

NAA upholds profittering on supply of "Fly Ash Blocks" for non-passing of benefit of reduction in rate of duty from.....

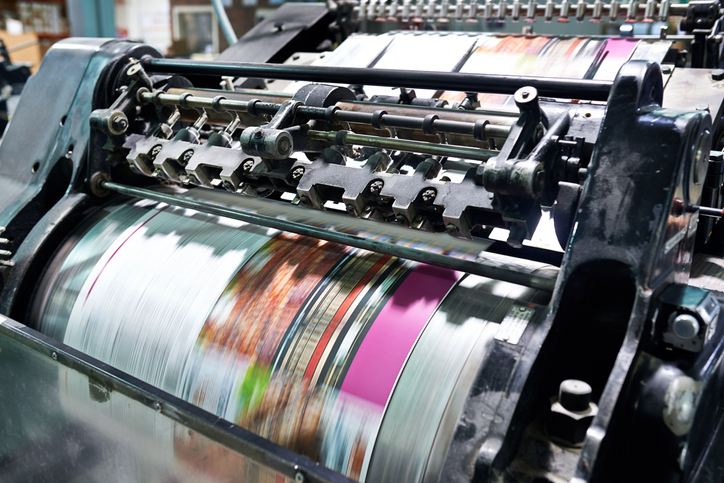

NAA: Upholds profiteering on supply of printing machine imported before GST implementation

NAA upholds case of profiteering on supply of “Used Heidelberg Speed Master Offset Press with complete tools and accessories” for.....

NAA: Rejects DGAP’s profiteering calculation using blocked ITC, directs further investigation

NAA rejects DGAP report alleging profiteering in respect of the construction service supplied by Respondent in its commercial project ‘U.....

NAA: Directs further investigation into specific issues, cites COVID-19 pandemic for delay in passing order

NAA directs further investigation in Respondent’s case basis clarification by DGAP that quantum of common ITC reversed, benefits of discounts.....

NAA: Rejects DGAP's report dismissing profiteering allegation against Realtor, directs further investigation

NAA rejects DGAP’s report against Respondent Sahej Realcon Pvt. Ltd. executing the project ‘Sahej Valley’, directs further investigation into the.....

NAA: Samsonite guilty of profiteering for failure to reduce MRP post rate reduction

NAA upholds Rs 26 Cr (approx.) profiteering allegation against Samsonite India (Respondent), holds that Respondent failed to pass on benefit.....

AAR: Rejects application on taxability of agri-produce auction, citing pendency of matter

Tamil Nadu AAR rejects application filed by a Cooperative Society seeking clarity as to whether any sale/purchase is involved in.....

AAR: Application withdrawn due to ‘unfavourable market conditions’ for business activity

Tamil Nadu AAR disposes advance ruling application owing to submission by applicant that due to unfavorable market conditions and other.....

AAR: ‘Britannia Winkin Cow Thick Shake’ a ‘Beverage’, not ‘milk’

Tamil Nadu AAR holds that UHT Sterilized Flavoured Milk marketed under the brand name ‘Britannia Winkin Cow Thick Shake' is classifiable.....

AAR: Supply of Law Journals in DVD/CD with dongle constitutes composite supply, not e-book

Tamil Nadu AAR holds that supply of DVDs/CDs with the ‘Law Weekly Desktop’ software to search and read law journals .....

HC: Citing Petitioner’s failure to upload TRAN-1, dismisses challenge to 'transitional credit' denial

Rajasthan HC dismisses writ challenging denial of transitional credit of Rs. 1 crore (approx.) stating that the assessee failed to demonstrate failure to.....

AAR : Aggregate turnover to include Non-executive Director’s salary, value of deposits, loans, residential property rent

AAR holds that incomes received towards (i) salary as a Non-executive Director of a Private Limited Company,(ii) Renting of Commercial.....

.jpg)

AAR : Denies 5% concessional rate to bulk drug supplied by Biocon Ltd. (DTA) as raw-material

AAR denies concessional rate of GST to bulk drug ‘Micafungin Sodium’ supplied by DTA unit of Biocon Ltd. intended to.....