News

AAR: Treats tamarind/ Imli/Chinta as seeds of forest trees, taxable at 5% GST

Andhra Pradesh AAR holds that the tamarind seed/kernel meant for commercial/industrial purpose sold by applicant to Millers, are seeds of.....

AAR: Leasing of property/building to lessee engaged in commercial activity of letting out rooms, liable to 18% GST

Andhra Pradesh AAR holds that service of renting out of building to lessee engaged in a commercial activity of letting of.....

AAR: Medicines supplied through pharmacy during medical treatment, ‘ancillary supply’ to healthcare-care service

Andhra Pradesh AAR holds that supply of medicines to in-patients through pharmacy as well as supply of medicines, drugs, stents,.....

AAR: Designing and printing flex banners for birthday, marriage etc attracts 12% GST

Andhra Pradesh AAR holds that supply of printed flex banner used for birthday, marriage and political purpose, amounts to supply.....

AAR: Denies concessional rate, construction service awarded by Andhra Pradesh Industrial Infrastructure Corporation Ltd. taxable at 18%

Andhra Pradesh AAR classifies the construction work namely building for office/IT space, awarded by the Andhra Pradesh Industrial Infrastructure Corporation Ltd. (APIIC).....

AAR: Allows unutilized ITC transfer upon ‘Transfer of Business as going concern’ upon filing GST ITC-02

Andhra Pradesh AAR rules the activity of ‘transfer of going concern’ by the applicant as ‘supply of services’ and allows.....

AAR: Marketing Consultancy services to overseas client an ‘Intermediary service’, not ‘Export’ despite payment received in foreign-exchange

Andhra Pradesh AAR holds that ‘marketing consultancy services’ provided by applicant to overseas client constitutes an ‘intermediary service’ and not.....

NAA: Directs Subway Franchisee to refund profiteered amount, benefit cannot be passed as per own convenience

NAA upholds profiteering against the Respondent operating a Restaurant as a Franchisee of M/s Subway India Pvt Ltd. alleging that.....

AAR: Letting out of 'Tug' taxable as ‘Time charter of vessels for transport of goods’ at 5%

Andhra Pradesh AAR classifies letting out of Tug Jupitar by the applicant on charter basis under Sl. No. 10 of.....

AAR: Rental of Non Air-Conditioned buses by State Road Transport Corp. taxable at 12% subject to conditions

Andhra Pradesh AAR holds that Andhra Pradesh State Road Transport Corporation (APSRTC) providing rental service of the Non Air Conditioned.....

AAR: Supply for mud activities and chemicals independent of mud engineering and drilling waste management Services

Andhra Pradesh AAR holds that supply of mud-activities and chemicals cannot be said to be in conjunction with supply of.....

AAR: Import of Drill Bits & supply thereof to ONGC’s location constitute two different supplies

Andhra Pradesh AAR holds that import of drill bits for supply to ONGC at its location in India does not.....

AAR: Rules on apportionment of credit in case of Banking company accepting deposits from customers

Bihar AAR holds that for claiming credit of GST paid, applicant (regional rural bank) engaged in the supply of services.....

AAR: Denies exemption to Institute providing coaching, food & accommodation facility to CA/ICWA aspirants/students

Andhra Pradesh AAR denies exemption to educational institution providing coaching to students for Chartered Accountancy Certificate (CA), Cost and Works.....

AAR: Interest/penalty charged by Chit Fund for delayed payments by members constitutes 'supply', taxable at 12%

Andhra Pradesh AAR holds interest/ penalty/late fee collected for delay in payment of monthly subscription by the members of Chit.....

AAR: 18% GST payable under RCM on lease agreement entered with Rail Land Development Authority

Rajasthan AAR rules that leasing services in pursuance to agreement (lease of residential & commercial development) of 99 years executed.....

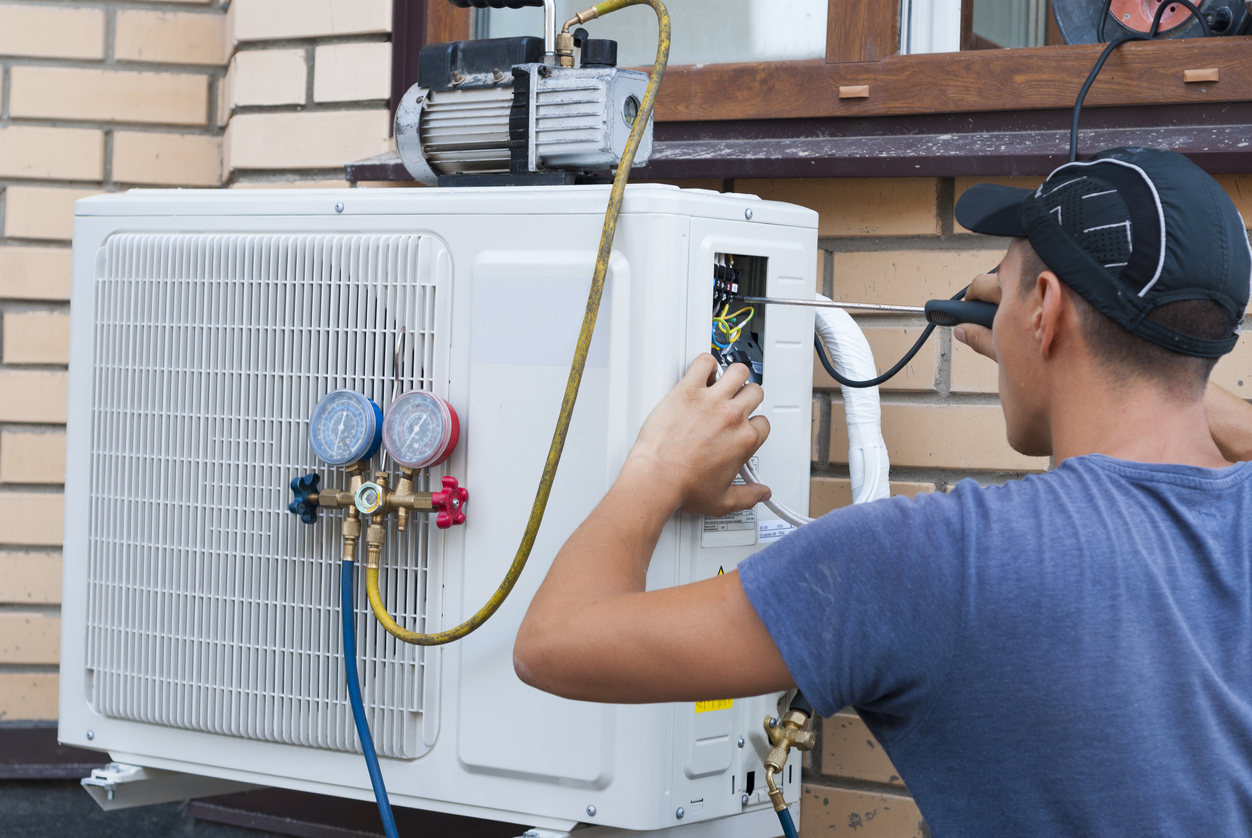

AAR: Fixing of air conditioner for a client on behalf of third party outside State an ‘inter-state’ supply

Goa AAR holds that supply of air conditioner and other installation services to client (recipient) on behalf of third party.....

AAR: 'Hand-Sanitizers' taxable at 18%, denies exemption as 'essential commodity' under GST

Goa AAR classifies Hand Sanitizers under Heading 3808, taxable at 18% as per Notification No. 1/2017 dated June 30, 2017;.....

NAA : Directs re-investigation against supplier of “Kiwi Shoe Polish”, DGAP to revisit profiteering-computation methodology

NAA rejects DGAP's report alleging profiteering on supply of “Kiwi Shoe Polish” for non-passing of GST rate-reduction benefit from 28%.....

NAA: Multiplex-operator held guilty of profiteering for not passing rate-reduction benefit on movie-ticket sale

NAA confirms profiteering allegation against Prasad Media Corporation, Hyderabad (Respondent) for increase in base-price of movie tickets despite reduction in.....