News

GST migration in Manipur from November 30 to December 15

Manipur Govt. notifies VAT dealers migration to GSTN from November 30 to December 15; All PAN validated dealers to be.....

GST Network crosses 1 lakh tax-payers enrolment

GST Network crosses 1 lakh tax-payers enrolment; GSTN CEO Prakash Kumar urges dealers to complete enrolment formalities without waiting for.....

GST Council meeting rescheduled on December 2-3

GST Council meeting pushed to December 2-3; Will deliberate on pending issues : PTI.....

GST Council meeting on November 25 cancelled

GST Council meeting on November 25 cancelled; new date yet to be finalized : PTI.....

GST migration in Daman & Diu to commence from November 28th

Union Territory of Daman & Diu notifies enrolment of existing dealers administered by VAT Department from November 28; States that.....

Maharashtra notifies dealers migration to GST portal from November 15 to 30

Maharashtra Govt. notifies enrolment of existing dealers administered by Maharashtra Sales Tax Dept. on GST portal from November 15 to.....

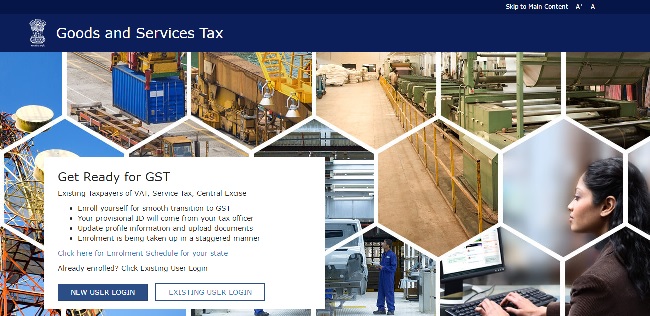

Central Govt. launches GST portal; Provides Enrolment Schedule of all States

Central Govt. launches GST portal – www.gst.gov.in for enrolment of existing taxpayers under VAT, Service Tax and Central Excise; Provides State-wise schedule.....

No consensus on dual control; Next Council meeting on November 24-25; Draft legislations by November 14-15

No consensus during GST Council meeting on dual control of assessees; FM Arun Jaitley says “we cannot have 2 assessing.....

GST Council announces 4 tier GST rate structure - 5%, 12%, 18% & 28% !

GST Council reaches consensus on 4 tier-rate structure; Fixes rates at 5%, 12%, 18% and 28% with zero tax rate.....

GSTN releases 56 FAQs on existing tax-payers' migration to GST System

GSTN releases FAQs on migration to GST system portal, whereby all existing tax-payers registered under Central Excise, Service Tax, Sales.....

Key Takeaways from Hangout with Adv. Rohan Shah & Gautam Doshi on 'GST Rate Conundrum'

The current debate on GST rate structure and proposition to impose Cess in order to fund the compensation to States,.....

GST rate structure requires "fine-tuning", need simpler dual-control model, says Kerala Finmin

Kerala FM Thomas Isaac speaking to CNBC TV-18 upon conclusion of third meeting of GST Council, assures that consensus on.....

Council to finalise fund sourcing for States compensation before formalising tax structure

Issue of tax rate structure depends on the question of source of funds for compensation to losing States, states FM.....

No consensus on GST rates; Council to meet again on November 4-5

No consensus on GST rates in current GST Council meeting; Deliberations may continue in next meeting to be held on.....

FM Arun Jaitley : GST Council reaches consensus on State compensation; Discussion on tax-structure to continue

GST Council reaches consensus on definition of ‘revenue’ to compensate states for revenue loss from GST implementation, base year to.....

Assam Govt. prescribes provisional GST migration procedure; Assessees to apply before Nov 6

Assam Govt. clarifies on enrollment of GST provisional Registration Number (GSTIN); States that assessees registered under VAT, CST, Entry Tax,.....

CBEC releases revenue estimates for Centre & States in first year of GST

CBEC releases revenue estimates to be garnered by Centre & States in the first year of GST implementation: CNBC TV-18.....

NACEN invites institutes & professional bodies for imparting GST training to trade & industry

NACEN, the apex indirect tax training institute of Govt. of India, invites Expression of Interest (EOI) from training institutes and.....

GST Council approves Draft Rules; Adopts 'tax & reimburse' approach for exempted entities

GST Council approves draft Rules with respect to registration, payment, returns, refunds and invoices / debit & credit notes, will.....

FM Arun Jaitley confident of meeting rollout date; Existing levies to continue till September 2017

FM Arun Jaitley, while speaking at the fourth meeting of Parliamentary Consultative Committee attached to the Ministry of Finance, affirms.....