News

GST Funda : Concept of 'Job work'

Under the GST law, ‘Job work’ means undertaking any treatment or process by a person on goods belonging to another.....

Central Govt. releases draft Rules on 'Accounts & Records', 'Advance Ruling' and 'Appeals & Revision'

Central Govt. releases draft GST Rules on Accounts & Records, Advance Ruling and Appeals & Revision; Invites public comments by.....

GST Funda : Concept of ‘Arrest’

The term “arrest” has not been defined in CGST / SGST law. However, as per judicial pronouncements, it denotes ‘the taking.....

Central Govt issues draft Rules on 'assessment & audit' and 'e-Way bills'

Central Govt. issues draft GST Rules on Assessment & Audit and Electronic Way Bills and invites comments thereon by April.....

CGST Bill receives President's assent

The Central Goods & Services Tax Bill 2017 receives Presidential assent on April 12th; The Act provides for levy and.....

IGST and UTGST Bills receive President's assent

The Integrated Goods & Services Tax Bill and the Union Territory Goods & Services Tax Bill receive Presidential assent on.....

GST Compensation Bill receives President's assent

Goods and Services Tax (Compensation to States) Bill receives Presidential assent on April 12th; The Act provides for compensation to.....

Natural justice principles to guide 'Anti-profiteering', centralised registration under consideration, says CBEC official

Commissioner of Central Excise & Service Tax Ravinder Saroop, in a fireside chat with CNBC TV-18 Managing Editor Shereen Bhan.....

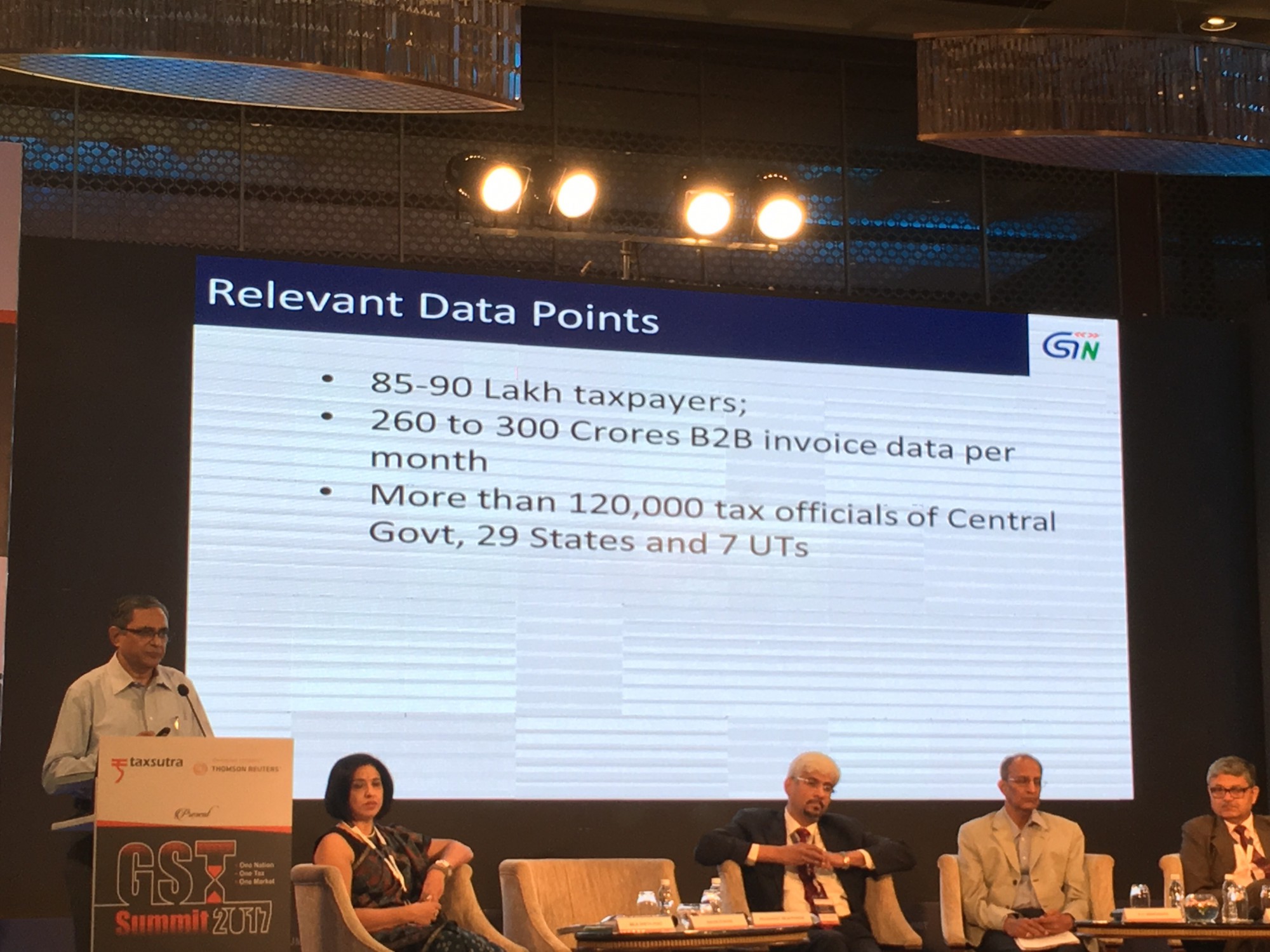

GST Summit 2017 : GSTN will handle 260-300 Cr invoices monthly, 85-90 lakh taxpayers' data, says GSTN Chief

GSTN Chairman Navin Kumar shares an overview of the role of IT system under GST regime, during the Taxsutra &.....

Lok Sabha passes Bill amending Customs & Central Excise laws for GST

Lok Sabha passes Taxation Laws (Amendment) Bill 2017 to amend Customs & Central Excise laws, aligning with GST.....

Rajya Sabha passes GST Bills without amendments

Rajya Sabha passes all 4 Central GST Bills without amendments.....

Karnataka introduces ‘Karasamadhana Scheme’ waiving interest / penalty on tax arrears before GST

Karnataka Govt. introduces Karasamadhana Scheme, 2017 (‘Scheme’) with an aim to reduce arrears of tax and other amounts before introduction.....

GST Rules provide 'open market' valuation, documentation & procedure for ITC availment, transition & composition

Draft “Rules for Determination of Value of Supply” provide for ‘open market’ valuation of supplies where consideration is not wholly.....

CBEC releases revised FAQs on GST

CBEC releases second edition of FAQs on the basis of CGST, SGST, IGST, UTGST and Compensation Cess laws, along with.....

Centre releases 8 GST Rules; Invites comments by April 10

Centre issues 8 GST Rules viz. Composition Rules, Valuation Rules, Transition Rules, ITC Rules, Revised Invoice Rules, Revised Payment Rules, Revised.....

CBEC issues 19 FAQs on GST Migration

CBEC issues 19 FAQs on migration to GST; Inter alia states that GST registration is based on PAN and State,.....

GST Council’s tentative approval to 4 Rules; Next meeting on May 18-19

GST Council gives tentative approval to Rules for Valuation, Composition, Input Tax Credit and Transition; Amends earlier Rules to align.....

Centre introduces Bill in Lok Sabha to amend Customs & Central Excise laws, aligning with GST

Centre introduces Bill in Lok Sabha to amend Customs Act, Customs Tariff Act, Central Excise Act, Finance Acts 2001 &.....

GST enrolment deadline extended to April 30

GST enrolment / migration deadline extended to April 30, 2017.....

18% standard service tax rate, biggest challenge is outreach to industry, says Revenue Secretary

Revenue Secretary Hasmukh Adhia tells CNBC TV18 Managing Editor Shereen Bhan that the biggest challenge for Govt. would be the.....