News

No IGST on import of goods & services by SEZs

Govt. exempts all goods and services imported by SEZ unit or developer from whole of Integrated tax leviable thereon u/s 3(7).....

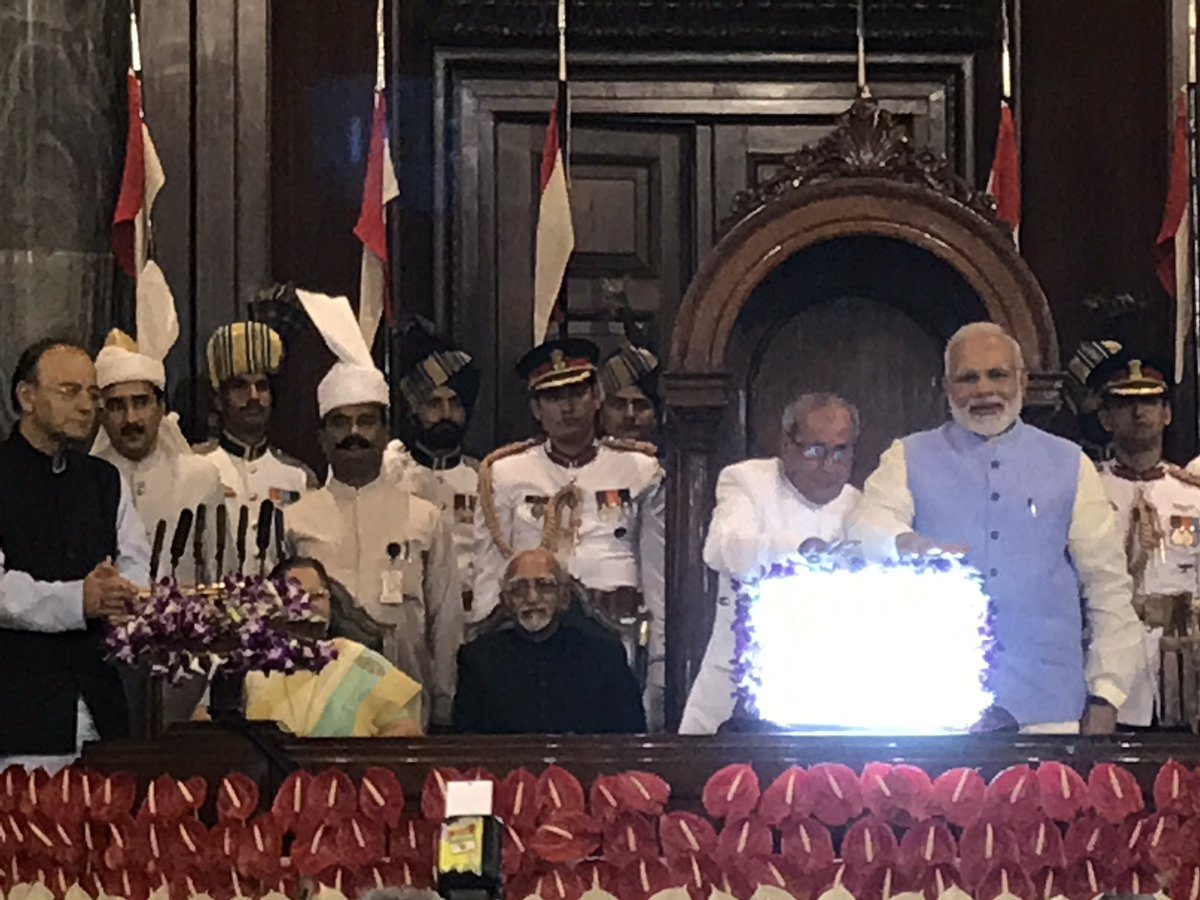

GST = Good & Simple Tax, says PM Modi as India enters new tax era

Goods & Services Tax launched at glitzy function in Central Hall of Parliament; PM Narendra Modi calls GST ‘Good &.....

GST Council reduces GST on fertilizers, tractor parts

GST Council on fertilizers reduced from 12% to 5%, while that on exclusive parts of tractors reduced from 28% to.....

.jpg)

Eye Share : Impact of GST on employers and employees

In less than 24 hours, the Goods & Services Tax (GST) is set to redefine many transactions which hitherto, were.....

CBEC's guidance note for importers-exporters explains procedural changes, duty calculation, refunds under GST

As Indian Customs gears up for GST roll-out, CBEC issues guidance note for importers and exporters to bring clarity about.....

Recipient's expenditure, packing & commission includible in taxable-value; No GST on discounts, explains CBEC

CBEC explains ‘valuation’ under GST regime, says that in most cases of regular normal trade, invoice value, i.e. the transaction value will.....

Finmin notifies service rates, exemptions, reverse charge, ITC refund disentitlement under GST

Central Govt. notifies rates of services, exemptions thereto, services chargeable under reverse charge mechanism, supplies which shall neither be supply.....

Finmin amends Drawback Rules to align with GST from July 1

Govt. notifies Customs, Central Excise Duties and Service Tax Drawback (Amendment) Rules, 2017” w.e.f. July 1 to align with GST law; Amends.....

Construction services taxable at 18% with 1/3rd land value deduction

Govt. hikes GST rate on services of construction of complex, building, civil structure or part thereof, including complex or building.....

Finmin notifies UTGST, Compensation Cess provisions, interest rates & HSN digits requirements under IGST

Central Govt. notifies Sections 6 to 16 (Administration, Levy & Collection of tax, Payment of tax, Inspection, Search, Seizure and.....

Govt. to unveil reviewed Foreign Trade Policy in September

Govt. to unveil Foreign Trade Policy in September, to factor in post-GST exporters’ feedback......

Govt notifies rates, exemptions, reverse charge, concessions for Central, Integrated, UT taxes & Compensation Cess

Central Govt. notifies GST Rate Schedules; Also issues multiple Notifications relating to exemptions, reverse charge, refunds and concessional rates for.....

Finmin notifies IGST provisions, reverse-charge on goods, ineligible ITC refunds, & CSD exemptions

Central Govt. notifies Sections 4 to 13 (administration, levy & collection, power to grant exemption, determination of nature of supply,.....

Finmin notifies CGST provisions, Rules, interest rates & HSN digits requirements on tax invoice

Central Govt. amends Central Goods & Services Tax Rules 2017 to notify provisions relating to Valuation, Input Tax Credit, Tax.....

Finmin amends Central GST Rules relating to composition, registration; Notifies composition scheme

Central Govt. notifies amendment to Central Goods & Services Tax Rules 2017 retrospectively w.e.f June 22; Inter alia provides for.....

Copies of 9 State GST Acts

Copies of Andhra Pradesh and Maharashtra GST Acts & Rules, Bihar GST Act, Chhattisgarh GST Act, Jharkhand GST Act, Uttarakhand.....

'Tax Recovery' provisions a "self-policing" system, encourage voluntary compliance, says CBEC

CBEC explains provisions relating to ‘recovery of tax’ under GST regime which work as a self-policing system, and can be.....

Every registered person obligated to maintain Accounts & Records for 6 years, says CBEC

CBEC explains Accounts & Records provisions which cast responsibility on owner, operator of warehouse or godown or any other place.....

No double taxation of High Seas Sales; Partner salary out of GST net

CBEC releases a short FAQ of 100 tweets received and answered by Govt’s tweeter handle – ‘askGST_GOI’, covering various aspects.....

.jpg)

Finmin defers TDS & TCS provisions; No immediate registration for suppliers through e-commerce

Finance Ministry defers implementation of provisions relating to Tax Deduction at Source (TDS) and Tax Collection at Source (TCS), after.....