News

Central Govt. notifies extension of Form GSTR-3B filing deadline

Central Govt. notifies extension of deadline for filing Form GSTR-3B for the month of July 2017, for specified class of.....

Govt. extends GSTR-3B/Form TRANS-1 filing deadline till Aug. 28

Finance Ministry issues press release, announces extension of deadline till August 28, for submission of GSTR-3B & Form TRANS-1; Govt......

Odisha Govt. notifies Form GSTR-3B filing extension to August 28; GST payable in cash

Odisha Finance Dept. notifies extension of Form GSTR-3B filing date for the month of July 2017, for specified class of.....

FAQs on Rates inter alia explain 'Retail Sale Pricing', GST on Export Incentive Licenses

FAQs on GST Rates inter alia clarify that prefabricated buildings, including portable and mobile toilets, fall under heading 9406 and.....

Exclusive : Govt. to soon notify GST return filing extension by a week

Govt. to soon issue a Notification extending deadline for GST return filing by a week; GSTN to put out TRAN-1.....

Finmin notifies duty concession on temporary import of leased machinery, equipment & tools

Central Govt. notifies customs duty and IGST concession for temporary import of leased machinery, equipment or tools falling under Chapters.....

.jpeg)

Govt. releases FAQs for traders; Inter alia explains composition & transitional credit schemes, returns filing

Govt. releases a set of FAQs for traders, inter alia explains the benefits of GST including removal of non-creditable CST.....

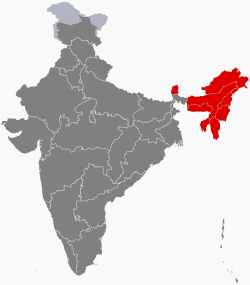

Govt. extends sunset date for Industries in North-East/Hilly states till 2027

Govt. extends sunset date for excise exemption granted to industries in North Eastern and hilly States until March 31, 2027;.....

Govt prescribes August 16 as last date for opting Composition Levy for migrated assessees

Central Govt. prescribes August 16, 2017 as last date to Opt-In for Composition Levy for migrated taxpayers from previous regime.....

DGFT conducts meeting of Regional Authorities/SEZ Commissioners on GST, mid-term FTP review

Director General of Foreign Trade (DGFT) conducts meeting of all Regional Authorities (RA) of DGFT and SEZ Commissioners on August 10.....

MoS explains GST incidence on fertilizers, plastic chairs, forest produce & solar panel

Minister of State (Finance) Mr. Santosh Kumar Gangwar replies to various question in Rajya Sabha pertaining to rationale of GST rates on fertilizers, minor.....

CBEC explains Reverse Charge Mechanism, registration mandatory, advance payment taxable under GST

CBEC explains Reverse Charge Mechanism (RCM) under GST law i.e. where liability to pay tax is on recipient of service,.....

.jpg)

No rate revision for hospitality industry & ayurveda; Tax incidence lower for banking sector

FM Arun Jaitley, in reply to question in Rajya Sabha pertaining to hospitality sector, allays fears of leakage in revenues and.....

Only 16k GST returns filed so far, no deadline extension yet, says GSTN Chairman

GSTN Chief Navin Kumar, in an exclusive interview to CNBC TV-18 Managing Editor Shereen Bhan, says that only 16,000 GST.....

Claim transitional ITC in Form TRAN-1 / 2, not Form GSTR-3B, clarifies GSTN Vice President

GSTN VP Shashi Bhushan Singh during a webinar, clarifies that transitional ITC cannot be claimed in GSTR-3B, says that "The.....

Claim transitional ITC in Form GSTR-3B, no reverse-charge on employee reimbursements, tweets Govt.

On a query put forth regarding claiming of ITC as on June 30, 2017 in Form GSTR-3B, Govt. of India.....

Haryana Govt. issues guidelines for detention / inspection of goods in transit

Haryana Govt. issues guidelines / instructions for detention / inspection report u/s 68 and 129 of Haryana GST Act /.....

GSTN grants option to cancel registration on GST portal

Taxpayers who have not filled Part B of their enrolment application, can now seek cancellation of registration on GST Portal;.....

West Bengal legislative assembly passes GST bill

West Bengal legislative assembly passes GST bill : ANI.....

.jpg)

CBEC notifies time limit extension for furnishing July & August GST Returns

CBEC notifies extension of time limit for furnishing returns under GST regime, Form GSTR-1 (outward supplies) for July to be.....