News

Govt. reduces GST on food preparations for free distribution to economically weaker sections

Govt. reduces GST rate on Food preparations put up in unit containers for free distribution to economically weaker sections of.....

Copy of CGST Rules 2017 updated till October 18

Copy of CGST Rules 2017 as last amended by Notification No. 47/2017-Central Tax; Said Notification inter alia provided for refund.....

Govt. notifies "deemed exports"; Clarifies issues relating to goods supplied on approval basis

Govt. notifies supply of goods against advance authorization, supply of capital goods against EPCG authorization, supply of goods to EOU.....

CBEC : No unutilised ITC refund against inverted duty structure arising in 'construction services'

CBEC explains refund of unutilised Input Tax Credit (ITC) which may occur in two scenarios – (i) if such credit.....

CBEC : Explains IGST refund against 'zero-rated supplies'; 90% provisional refund available within 7 days

CBEC explains refund of Integrated Tax on account of ‘zero rated supplies’ under GST, states that there is no burden.....

Eye Share : Input Tax Credit Of AMCs - A Disguised Pain Under GST

In today’s competitive era, quality is a prime factor. Annual Maintenance Contracts (‘AMCs’) come in handy after a product’s warranty.....

CBEC : "E-Way Bill" to ensure compliance & check evasion; Non-adherence attracts penalty & detention / seizure

CBEC explains concept of “E-Way Bill” under GST, stating that it has been devised to ensure that goods being transported.....

Revenue figures still 'unclear', no penalty waiver for delayed returns, says Revenue Secretary

Revenue Secretary Dr. Hasmukh Adhia clarifies various aspects on GST during Town Hall organized by CNBC TV-18 & CII, says.....

.jpg)

Govt. notifies import duty exemption for Advance Authorisation & EPCG schemes & EOUs

Central Govt. notifies exemption from IGST and Compensation Cess for imports under EPCG & various Advance Authorisation Schemes upto March 31,.....

Govt. notifies GST Council recommendations deferring 'RCM', tweaking 'composition' provisions, & reducing 'rates'

Govt. notifies exemption from payment of tax on reverse charge basis in respect of supplies from unregistered suppliers u/s 9(4).....

Govt. extends return filing date for composition dealer, OIDAR, ISD for period July-September

Govt extends the time limit for furnishing returns by various taxpayers for the months of July, August & September 2017;.....

Vehicles purchased & leased before July 1 to attract GST at 65% of applicable Rate + Cess

Finmin explains decision of GST Council to provide relief to old / existing lease of motor vehicles; Leasing of vehicles.....

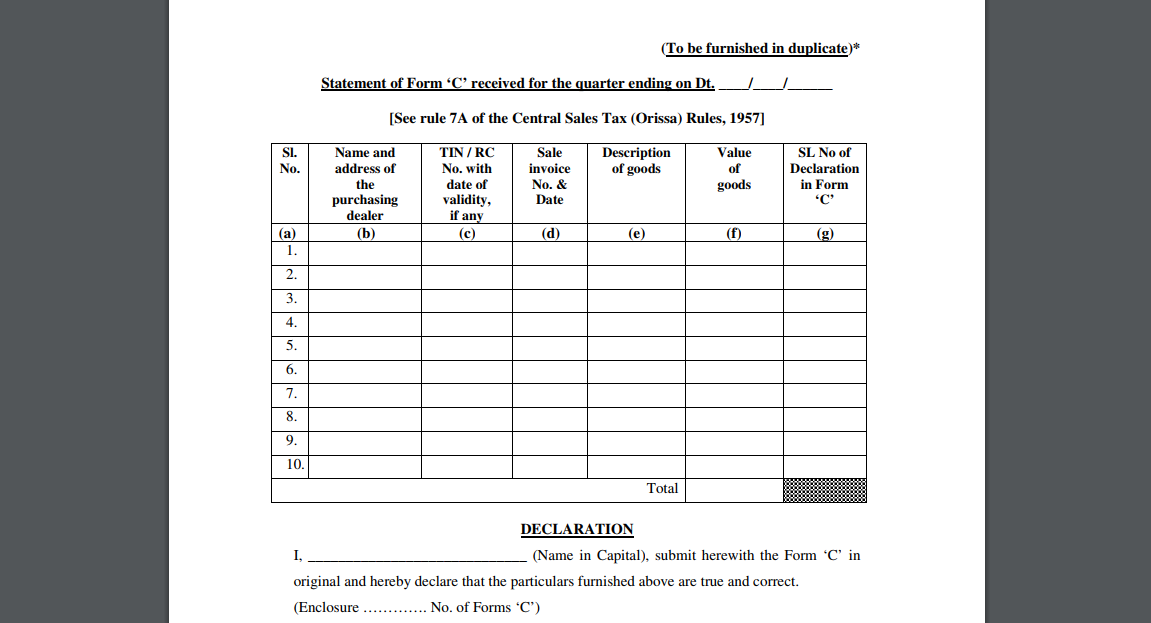

Exclusive : Orissa HC admits challenge to Circular invalidating dealers' CST registration & barring inter-state 'Form C' purchases

Orrisa HC admits writ petition challenging validity of Circular dated August 17, 2017 which invalidated registration certificates of all dealers.....

Finmin explains GST Council's rate structure recommendations to incentivize investments in E&P sector

Finance Ministry explains GST Council recommendations made to reduce cascading of taxes arising on account of non-inclusion of petrol, diesel,.....

No further extension of due date for filing July's Form GSTR-1, clarifies Govt

Central Govt. states that no further extension shall be given to taxpayers for filing Form GSTR-1 for month of July;.....

CBEC prescribes detailed guidelines for claiming IGST refund on exports

CBEC lays down guidelines for refund of IGST against exports under Rule 96 of CGST Rules; States that filing of.....

CBEC calls for Centre & States coordination to ensure uniform stands in GST related petitions

CBEC calls for coordination between State & Central Govt. in GST related petitions before the HCs so as to obviate.....

No IGST on imports by Advance / EPCG authorisation-holders, EOUs; Nominal GST for merchant-exporters

GST Council addresses the concerns of export sector, announces payment of held-up IGST refunds for July by October 10 while August backlog.....

Council rationalizes rates for various services; 35% GST + Cess abatement for leased vehicles

GST Council rationalizes tax rates for services including various job-works, decides to tax leasing of vehicles purchased and leased prior.....

Govt. introduces partial GST reimbursement for units in special category States upto June 2027

Govt. introduces a scheme for eligible units located in J&K, Uttarakhand, Himachal Pradesh and the North Eastern States including Sikkim.....