News

Council resolves ambiguity regarding EPC contracts taxability, exempts IIMs degree/diploma, slashes peak 28% rate

31st meeting of GST Council considers process of rate rationalization and balancing revenue flows; All goods except sin goods, auto-parts and cement.....

Due dates for Annual returns extended, new return filing system proposed from April 1

GST Council in its 31st meeting today announces extension in due dates for furnishing annual returns in FORM GSTR-9, FORM.....

GST Council meeting underway, announces rate reduction for several items

GST Council's 31st meeting underway; Rate on 7 items including tyres, VCR, Lithium Batteries, Billiards & Snookers to be reduced from peak rate of.....

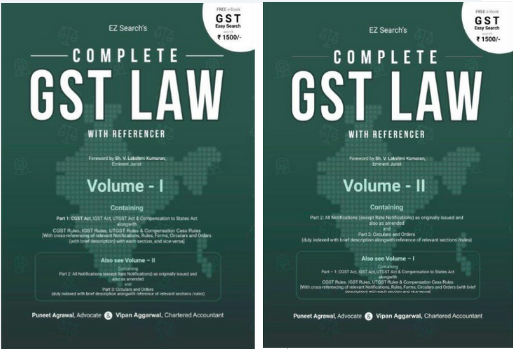

Book Review : 'Complete GST Law with Referencer' by Puneet Agrawal & Vipan Aggarwal

Since the introduction of GST from July 1, 2017 there have been innumerable changes in GST law via various amendments,.....

Eye Share : GST implication on Transfer Pricing adjustment - Part I

As the due date of transfer pricing compliances for the AY 2018-19 is just passing away, it is important to.....

GSTN starts sharing mis-match data with tax authorities; Focuses on new return filing development

GSTN starts sharing data with tax authorities on - a) Mis-match between figures reported in GSTR-1 & GSTR-3B, b) Mis-match.....

Eye Share : Evolving Law on E-way Bill Requirements

Rule 138(1) of CGST Rules requires a registered dealer to generate E-way bill upon causing movement of goods of consignment.....

Govt. releases GST evasion figures for current FY (April to November 2018)

Govt. explains GST evasion amounting to Rs. 12766 crore (apprax.) till the month of November, 2018 identifying 3196 cases, out.....

Govt. releases month-wise gross collection figures of GST for FY 2017-18 and FY 2018-19

Govt. releases month-wise gross collection figures of CGST, SGST, IGST and Cess For FY 2017-18 and FY 2018-19; Explains that,.....

.jpg)

Govt. releases total Direct and Indirect Tax collection figures for FY 2017-18, 2016-17 & 2015-16

Govt. releases details of total Direct and Indirect tax collections for the last 3 financial years (FYs); Reports total Indirect.....

Eye Share: GST Audit – A new era begins (Part – 3)

In Part I of their 3 series article, Mr. Rakesh Jain (Director of Indirect Tax, Annveshan Business Solutions Pvt. Ltd.) along with Ms. Aishwarya. R......

Govt. notifies due date extension for filing annual return for July 2017 to March 2018

Finance Ministry notifies extension of due date for filing the annual return for the period from the July 1, 2017.....

Eye Share : Concept of Job Work under GST

As per GST Act, job work means any treatment or process undertaken by a person on goods belonging to another.....

Govt. clarifies effective ITC to builders pre & post GST, requires passing lower tax benefit

FinMin issues clarification on effective rate of tax and credit available to builders for payment of tax under pre and post.....

Due date for GSTR-9 extended upto March 31, 2019

Govt. extends due date for filing of FORM GSTR-9, FORM GSTR-9A and FORM GSTR-9C till March 31, 2019; Requisite FORMs to.....

Eye Share : GST Audit - A new Era begins - Part II

In Part I of their 3 series article, Mr. Rakesh Jain (Director of Indirect Tax, Annveshan Business Solutions Pvt. Ltd.) along with Ms......

Eye Share : Intricacies in filing GSTR 9 - Part III

In part I and part II of the 3 series article, Mr. Gaurav Kenkre (G.S. Kenkre & Associates, Chartered Accountants), discussed about Part I of GSTR 9,.....

Govt. releases GST refund status, explains 93% disposal rate, solicits exporter's co-operation

Govt. explains that GST refunds to the tune of Rs. 91,149 crore have been disposed by CBIC and State authorities.....

.jpeg)

CBIC releases updated FAQ on TCS under GST

Govt. releases updated FAQs on TCS under GST; Explains that “The highlighted portions in red are the newly added answers.....

Govt. releases Revenue figures for November 2018, collections lower than October by 3.05%

Govt. releases GST collection figures for the month of November; Explains that total gross GST revenue collections for the month.....